Crypto Market Manipulation? How Derivatives Actually Move Bitcoin and XRP

In the wake of any sharp, downward move in the cryptocurrency market, a familiar narrative swiftly floods social media channels

Latest

Understanding Crypto Market Timing: Cycles, Liquidity, and Data Signals

In traditional finance, market timing refers to the strategy of making buying or selling decisions by attempting to predict future

TASC Launches the Scamberry Pie Campaign to Raise Holiday Scam Awareness

A new public scam awareness initiative is launched to combat the annual surge in online fraud. The Tech Against Scams

Apple ID Email Scam 2025 Spot The Fake Email and Protect Your Account

What Is an Apple ID Email Scam? An Apple ID email scam is a type of phishing attack where criminals send

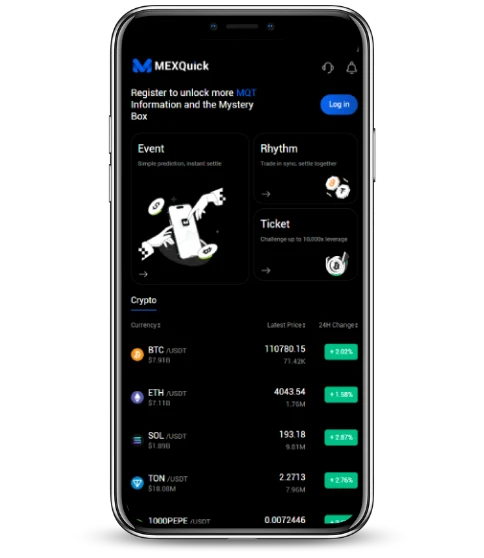

Start your Journey Now!

Crypto Investment Ideas

FAQs

What is MEXQuick?

We are a Web3 trading infrastructure built to support short-term derivatives products and automated liquidity systems. Rather than operating as a traditional spot exchange, we focus on structured trading models where risk parameters, execution logic, and liquidity behavior are defined at the system level. Our role is to provide a transparent, rules-based trading framework instead of acting as a conventional broker or centralized exchange.

How does MEXQuick work?

We operate through contract-based trading structures in which outcomes follow predefined conditions rather than manual order matching. Our platform combines short-duration trading products, AI-assisted liquidity management, a dual-token economic design, and social participation features. By standardizing product logic and managing liquidity at the system level, we aim to deliver a consistent, transparent, and sustainable trading environment for users in different markets.

What products does MEXQuick offer?

We offer a range of structured, contract-based trading products designed to suit different trading styles and time horizons. Each product is built to simplify participation by standardizing risk exposure and removing the need for complex order placement. Our ecosystem also includes internal utility mechanisms that support participation, incentives, and long-term system balance.

Who is MEXQuick designed for?

We design MEXQuick for users who engage with short-duration trading models and system-based financial participation. Our infrastructure is built for those who value predefined risk structures, automated execution logic, and streamlined decision-making rather than manual trade management. MEXQuick is typically used by short-term traders, system-focused participants, and individuals exploring structured trading environments outside traditional exchange models.