What Are Trading Order Types and Why They Matter

A trading order type is a specific instruction given by a trader to a broker or exchange to execute a transaction buying or selling a financial instrument under clearly defined conditions. These conditions dictate three critical elements: price, speed, and time (duration). The decision of which order type to use is the single most fundamental choice a trader makes, as it directly governs the trade’s execution quality, the risk of unfavorable price movement (slippage), and the overall strategic intent.

In the complex and rapidly evolving global markets spanning highly regulated equities (stocks), high-leverage futures, and 24/7 volatile crypto assets a deep understanding of execution mechanics is not optional; it is the foundation of risk control. Different order types serve different, mutually exclusive goals: some prioritize immediate execution speed regardless of price, while others prioritize price certainty at the expense of speed.1

This comprehensive educational article, developed in line with the rigorous standards of the CME Group Education and Nasdaq Academy, provides an analytical breakdown of how various trading order types function across asset classes. Our goal is to empower readers with the technical knowledge necessary to define their execution, risk, and strategy precisely reinforcing that every order is a calculated decision, not a guess.

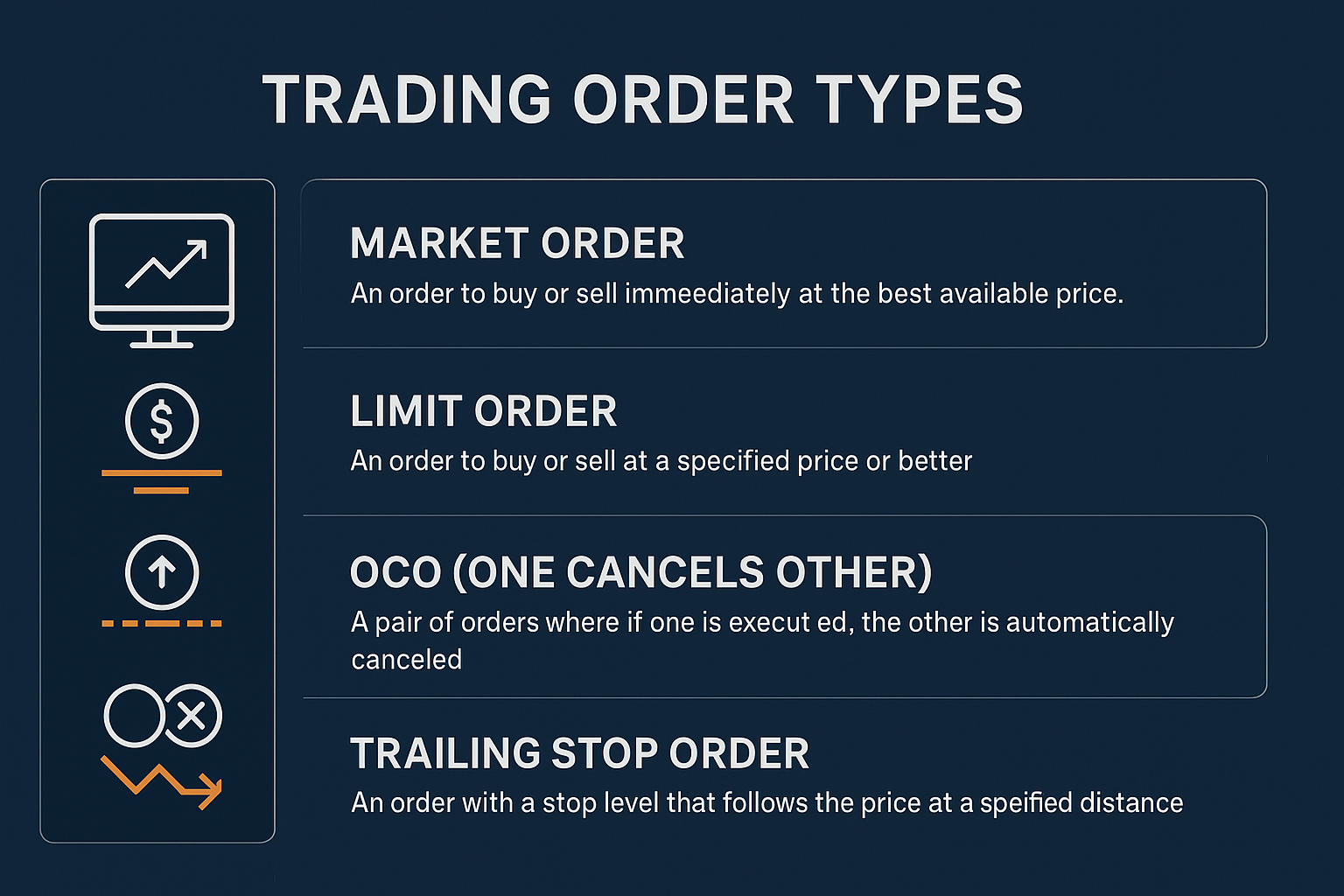

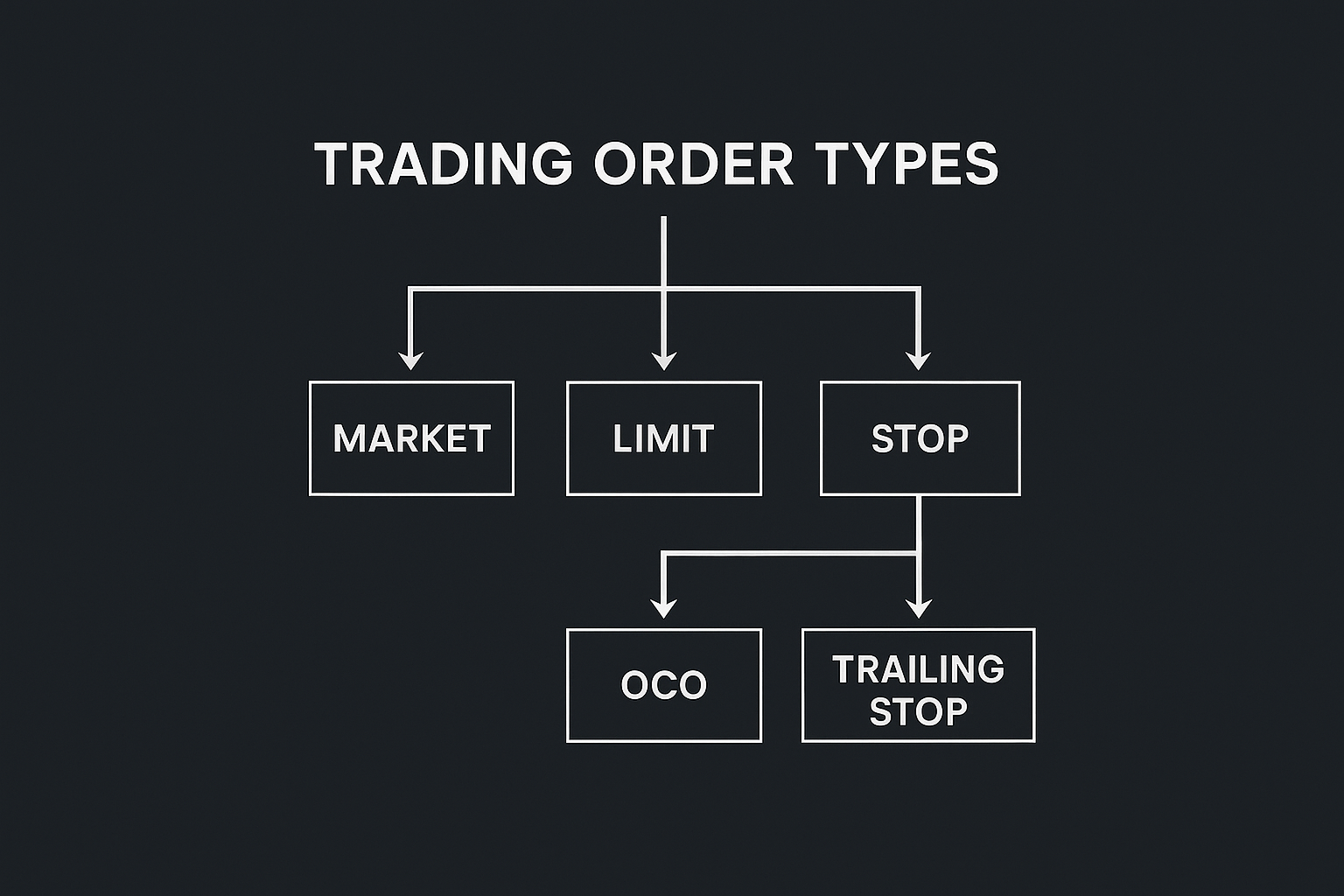

Core Orders Market, Limit, and Stop Instructions

The foundation of all trading execution rests on three primary order types.2 While they are conceptually simple, their mechanical behavior and risks vary significantly across different market structures.

1. Market Orders

A Market Order is the simplest instruction: an order to buy or sell immediately at the best available current price.3

- Execution Priority: Speed and certainty of execution.

- Price Priority: None. The trader accepts whatever price is necessary to fill the order now.

- Mechanics: The order aggressively “takes” liquidity from the best opposite-side offers (ask) or bids (buy) resting on the Limit Order Book (LOB). It sweeps through price levels until the entire volume is filled.

- Risk: Slippage Risk. In fast-moving, low-liquidity, or large-volume scenarios, a market order can execute across multiple price levels, resulting in an average execution price significantly worse than the quoted best price.4 This risk is notably higher in volatile crypto or thinly traded futures contracts than in highly liquid large-cap equities.5

- When to Use: When certainty of entry/exit is paramount, such as immediately responding to a sudden news event or escaping a pre-defined maximum loss threshold.

2. Limit Orders

A Limit Order is an instruction to buy or sell at a specified price or better.6 It is a passive order designed to provide liquidity and control the execution price precisely.

- Execution Priority: Price certainty.

- Price Priority: Absolute. A buy limit order placed at $50.00 will not execute above $50.00.

- Mechanics: A limit order does not execute immediately unless the market price is already equal to or better than the limit price.7 If not, it rests on the Limit Order Book (LOB), waiting for a counterparty. Resting orders are typically considered Maker trades and may receive fee rebates (Maker-Taker model).

- Risk: Non-Execution Risk. The market may trade near the limit price and reverse without ever filling the order. The trade-off for price control is the risk of missing the desired move.

- When to Use: For planned entries at specific support/resistance levels, to harvest potential Maker rebates, or when execution price quality is prioritized over speed.

| Feature | Market Order | Limit Order |

| Primary Goal | Execution Speed | Price Control |

| Liquidity Role | Taker (Removes from LOB) | Maker (Adds to LOB) |

| Primary Risk | Slippage | Non-Execution |

| Execution Price | Best available now | Specified price or better |

3. Stop Orders (Stop Market)

A Stop Order is a dormant instruction that only becomes a Market Order once a specific trigger price (the stop price) is reached.8

- Function: It is primarily used for risk management (Stop Loss) or strategic entry (Stop Entry).

- Mechanics:

- The market price must trade at or through the stop price.

- Once triggered, the order immediately converts to a standard Market Order.

- Risk: Execution Price Uncertainty. Because it converts to a Market Order, the final execution price can be significantly worse than the stop price, especially during high-volatility events, overnight gaps, or regulatory halts where the price slips through the stop level.9 This is often referred to as volatility gap risk.

- Stop Price Trigger (Equities vs. Derivatives):

- Equities (Reg NMS): Often triggered by the Last Sale Price (LSP) or the National Best Bid/Offer (NBBO).

- Futures/Crypto: Can be triggered by the Last Traded Price, the Mark Price (for derivatives), or the Index Price (a composite of multiple exchanges to prevent manipulation).10 Traders must be explicitly aware of the trigger mechanism on their exchange (e.g., stop on quote vs. stop on trade).

- When to Use: To automate a risk-management exit (stop-loss) or to participate in a breakout move once a key technical level is breached.

Advanced Protection Stop Limit, Trailing Stop, and Bracket Orders

Building on the core functions, these orders introduce additional layers of control over execution price and risk exposure.

4. Stop Limit Orders

A Stop Limit Order solves the primary risk of the Stop Market order by introducing a limit price after the trigger.11

- Mechanics:

- The order has two prices: a Stop Price (trigger) and a Limit Price (max/min acceptable price).12

- When the market trades at or through the Stop Price, the order converts into a Limit Order at the specified Limit Price.

- Risk: Non-Execution Risk. If the price moves too quickly and gaps past the Limit Price before the order can fill, the order may not be executed, leaving the trader exposed to the intended loss.13

- Trade-off: Offers price certainty but sacrifices execution certainty.

- When to Use: When a trader needs protection but is unwilling to accept significant slippage (e.g., in volatile, low-liquidity micro-cap stocks or obscure altcoins).

5. Trailing Stop Orders

A Trailing Stop Order is a sophisticated stop-loss instruction designed to lock in profits as the market moves favorably, without manual intervention.14

- Mechanics:

- The order is placed a specific distance (Trailing Amount) below the current market price (for a long position) or above (for a short position). The Trailing Amount can be defined as an absolute dollar value, a percentage, or a tick/point value.15

- As the price moves up (for long), the stop price automatically moves (trails) with it, maintaining the set distance.16

- If the price moves down (for long), the stop price locks in place and does not adjust lower.

- If the price reaches the locked stop price, the order triggers a standard Market Order (or sometimes a Stop Limit Order, depending on the exchange).

- Benefit: Allows a trader to participate in a large trend while automating an exit to protect the realized profit margin.

- When to Use: Trend-following strategies, allowing profitable trades to run while minimizing the risk of a full reversal.

6. Bracket Orders (OCO/Stop-Loss/Take-Profit)

A Bracket Order is a simultaneous instruction to enter a position and immediately attach two contingent exit orders: a Take Profit Limit Order and a Stop Loss Order.18

- Structure: It is an inherent risk-management strategy that defines the trade’s profit goal and maximum loss risk before the trade is opened.

- Core Feature: One Cancels the Other (OCO) Relationship. If the Take Profit Limit Order is filled, the Stop Loss Order is automatically canceled, and vice versa.19

- Mechanics (Three Parts):

- Entry Order: The initial Market or Limit order to open the position.

- Take Profit: A Limit Order placed above the entry (for long) to secure a favorable exit price.

- Stop Loss: A Stop Order (Market or Limit) placed below the entry to cap the maximum loss.20

- Risk Management: Critical for maintaining a consistent Risk/Reward Ratio and enforcing the rule that every trade must have an exit plan. This structure is often mandatory for proprietary trading firm risk systems (Bracket Risk Management).

- When to Use: Standard operating procedure for high-frequency or high-leverage trading (like futures and margin crypto) where a predefined risk profile is essential.

Specialized Execution IOC, FOK, GTC, GFD, and Time-in-Force Settings

Beyond price instruction, every order carries a Time-in-Force (TIF) parameter, which defines how long the order remains active and what happens if it cannot be immediately filled.21 TIF settings are vital for liquidity providers and execution specialists.

7. Time-in-Force (TIF) Settings

| TIF Instruction | Description | Execution Outcome | Common Use Case |

| Good-Til-Canceled (GTC) | The order remains active on the LOB until it is fully filled or the trader manually cancels it. | Remains open indefinitely (up to regulatory limits, e.g., 90 days in equities). | Long-term investment entries/exits at specific prices. |

| Good-For-Day (GFD) | The order remains active only until the end of the current trading session (or a specific closing time). | Canceled automatically at the close of the market (or 24 hours for crypto). | Orders that should not be exposed to overnight/weekend gap risk. |

| Immediate-Or-Cancel (IOC) | Any portion of the order that can be filled immediately must be filled. The unfilled portion is canceled immediately. | Allows for Partial Fill. Prioritizes immediate execution for maximum available liquidity. | Large institutional orders seeking immediate best execution without wanting a residual resting order. |

| Fill-Or-Kill (FOK) | The entire order volume must be executed immediately and in full. If not, the entire order is canceled immediately. | Allows for Complete Fill Only. Requires an exact amount of available counter-liquidity at the desired price. | High-conviction, time-sensitive trades where a partial fill is unacceptable (e.g., options hedges). |

| Good-Til-Date/Time (GTD) | The order remains active until a specific date and time set by the trader. | Canceled automatically on the specified date/time. | Time-sensitive trades around economic announcements or contract rollovers. |

Understanding Partial Fill vs. Complete Fill is crucial here: IOC allows partial fills; FOK strictly demands a complete fill.22

Linked Orders OCO and OTO Strategies for Risk Control

Order linking refers to creating dependency between two or more independent order instructions, forming cohesive multi-step strategies.

8. One-Cancels-the-Other (OCO)

The OCO is the core of the Bracket Order strategy (discussed above) but can be used independently.

- Mechanism: Two separate, contingent orders are simultaneously placed. The execution of one automatically triggers the cancellation of the other.23

- Typical Pairing: A Buy Limit Order and a Buy Stop Order are placed at different sides of the current market price.24 This allows the trader to capitalize on either a breakout (Stop) or a pullback (Limit) from a central price without executing both.

- Risk Management: Prevents the accidental doubling of risk or position size if both conditions are met.

9. One-Triggers-the-Other (OTO)

The OTO structure sets up a sequence where the filling of a primary order immediately triggers the placement of one or more secondary, protective, or strategic orders.25

- Mechanism: An initial order (e.g., a Market Order to buy) is placed. Upon its full or partial execution, the secondary order(s) (e.g., a Stop Loss and a Take Profit Limit) are automatically placed on the LOB.

- Use Case: Ideal for automating position entry and the subsequent risk management in a single workflow. It allows the trader to define the position’s fate before it is even executed.

- Relationship to Bracket: While a Bracket Order is often a single, pre-packaged OTO/OCO combination, the standalone OTO mechanism allows for custom, multi-step sequencing.

Algorithmic and Conditional Orders TWAP, VWAP, and Iceberg Execution

For large-volume trades, submitting a single Market Order would cause significant market impact and slippage. Institutions utilize complex, non-standard order types executed by broker-driven algorithms (Algorithmic Order Types) to minimize this impact.

10. Iceberg Orders (Discretionary Order with Hidden Amount)

An Iceberg Order is a large-volume Limit Order where only a small portion is visible (Displayed Quantity) on the Limit Order Book.27 The vast majority of the order remains Hidden Liquidity (Reserve Quantity)

- Goal: To execute a large volume discreetly while minimizing market impact and preventing other traders from front-running the order.28

- Mechanics: When the displayed portion is filled, the system automatically refreshes it with another portion from the hidden reserve at the same limit price (or potentially a price within a discretionary range, known as a Discretionary Order).

- Risk: The non-displayed portion has lower Queue Priority than the displayed portion of other orders at the same price. The execution may be slow.

- When to Use: By large traders (e.g., mutual funds, proprietary trading desks) needing to move substantial capital without announcing their intent.

11. Time-Weighted Average Price (TWAP) and Volume-Weighted Average Price (VWAP)

These are not single order types but sophisticated Execution Algorithms (Algos) that dynamically split a large order into small, continuously managed child orders over a period of time.

- TWAP (Time-Weighted Average Price): The algorithm aims to execute the order evenly over a specified time interval (e.g., “Buy 10,000 shares over the next 4 hours”).29 Its goal is to achieve an average execution price close to the market’s average price during that period.

- VWAP (Volume-Weighted Average Price): The algorithm monitors real-time market trading volume and dynamically adjusts the rate of execution to match the market’s natural volume distribution. Its goal is to achieve an average execution price close to the actual VWAP benchmark of the market.

- Context: Used almost exclusively in equities and high-volume futures markets to achieve the best possible institutional Execution Quality and lower Transaction Cost Analysis (TCA) results.

12. Conditional and MIT/LIT Orders

These orders add logical conditions that must be met before the order even becomes active.

- Market-If-Touched (MIT) / Limit-If-Touched (LIT): These are essentially the inverse of Stop Orders.

- LIT: A dormant order converts to a Limit Order once a predetermined trigger price is touched by the market. Used for pullback entries.

- MIT: A dormant order converts to a Market Order once a predetermined trigger price is touched by the market.

- Conditional Triggers (Crypto Futures): In the crypto derivatives space, orders can be triggered based on non-standard inputs: the Mark Price (used for calculating margin and liquidation) or the Index Price (a stable composite price). This protects against liquidations based on temporary, isolated price spikes on a single exchange.

Hidden Liquidity Pegged, Midpoint, and Post-Only Orders Explained

These order types relate fundamentally to the liquidity provision mechanism and the priority of orders within the Limit Order Book (LOB). They are commonly used by professional market makers.

13. Pegged and Midpoint Orders

A Pegged Order is a Limit Order whose price is not fixed but is dynamically tied or pegged to a reference price.30

- Primary Peg (Bid/Ask Peg): The order price automatically adjusts to the best current bid or ask price.31 If the best bid moves up, the order price moves up with it. This ensures the order always maintains top Queue Priority for displayed orders.

- Midpoint Peg: The order is always pegged exactly to the midpoint of the current National Best Bid and Offer (NBBO). This order is typically Non-Displayed (Hidden) and can only execute when an incoming Market Order crosses the midpoint.

- Benefit: Allows execution at a price that is better than the current bid and the current ask (capturing the spread) but without adding any visible pressure to the order book.

- Context: Heavily used in Dark Pools and regulated venues to execute large volumes away from the public order book.

14. Post-Only and Reduce-Only Orders

These are crucial tools for controlling fees and managing risk, particularly in derivatives markets.

- Post-Only Limit Order: This is a Limit Order with an additional instruction: only place this order on the LOB if it will be a Maker (liquidity provider) trade.

- Mechanics: If, upon submission, the order would immediately execute by crossing the best price (and thus be a Taker trade), it is immediately canceled by the exchange.

- Goal: To guarantee the Maker fee rebate and avoid Taker fees, strictly ensuring the order provides liquidity.

- Reduce-Only (Derivatives): An instruction used on derivatives exchanges (futures/crypto) to ensure an order can only decrease the size of an existing position.

- Goal: Risk control. If a Stop Loss or Take Profit order with the Reduce-Only tag is partially filled, the remaining volume will be automatically canceled if the remaining position size is zero. This prevents accidental opening of a new, unintended opposite-side position (Self-Trade Prevention (STP) is a related feature).32

Market Structure Context Limit Order Book, Slippage, and Liquidity

The efficacy of any order type is fundamentally dependent on the underlying market structure, the core of which is the Limit Order Book (LOB).

The Limit Order Book (LOB)

The LOB is a real-time record of all outstanding, resting Limit Orders for a security or contract, organized by price level.33

- Bid-Ask Spread: The difference between the highest price a buyer is willing to pay (Best Bid) and the lowest price a seller is willing to accept (Best Ask). Tighter spreads indicate high liquidity.34

- Market Depth: The cumulative volume of orders resting at various price levels away from the best bid/ask. Deep markets absorb Market Orders with less price impact.35

- Queue Priority: Orders at the same price are filled based on Time Priority the order submitted first is filled first. The time-stamp of a resting Limit Order is paramount.

Execution Quality and Slippage

Execution Quality is the measure of how closely the final execution price matches the expected price.36

- Slippage: The difference between the expected price (e.g., the Stop Price or the quoted best price at the moment of submission) and the final executed price.

- Negative Slippage: Execution at a worse price (common with Market Orders during volatility).37

- Positive Slippage: Execution at a better price (can occur with Limit Orders if the price improves upon submission).38

- Liquidity and Market Impact: Low liquidity magnifies slippage.39 A large Market Order in a thin market will consume all available volume, significantly moving the price against the trader this is called high Market Impact. Understanding this dynamic is key to correctly sizing orders and utilizing execution algos like TWAP/VWAP. (Internal Link: Market Mechanics)

Regulation and Best Execution

Regulatory frameworks like the U.S. Reg NMS (National Market System) and the EU’s MiFID II (Markets in Financial Instruments Directive II) mandate that brokers seek “best execution” for client orders, taking into account price, cost, speed, likelihood of execution, and settlement size. This requirement drives the use of complex Smart Order Routing (SOR) systems to scan multiple exchanges, dark pools, and alternative trading systems (ATS) for the best price, which often involves the broker internally managing and fragmenting the order across various venues.40 (External Link: NASDAQ Market Regulations)

Choosing the Right Order Type Practical Examples and Risk Factors

Selecting the appropriate order type is a function of the trader’s primary goal for that specific transaction. There is no universally “best” order type, only the one that best matches the strategic intent and acceptable risk profile.

| Trader Goal | Order Type | Risk Profile | Execution Certainty | Price Certainty |

| Urgent Entry/Exit | Market Order | High Slippage | Highest | Lowest |

| Set a Target Price | Limit Order | Non-Execution | Lowest | Highest |

| Automate Stop-Loss | Stop Market | Volatility Slippage | High | Low |

| Stop-Loss w/ Price Cap | Stop Limit | Non-Execution (Gap Risk) | Low | Medium/High |

| Discreet Large Volume | Iceberg Order | Slow Execution / Queue Jump | Medium | High |

| Automated R/R Entry | Bracket Order (OCO/OTO) | Defined Max Loss | High (entry) | Medium (exits) |

| Ensure Maker Fee | Post-Only Limit | Cancellation | Low | High |

Practical Scenario: Trading an Earnings Report

A high-volatility event like an earnings report exemplifies the order type dilemma how trading:

- Trader A (Prioritizing Participation): Uses a Market Order to ensure they are filled immediately post-announcement. Risk: The price gaps severely, and they execute at a much worse price than expected.

- Trader B (Prioritizing Price): Uses a Limit Order at a key support level. Risk: The price moves sharply away and never touches the limit, resulting in non-execution and a missed opportunity.

- Trader C (Prioritizing Risk Control): Uses a Stop Limit Order for entry. Risk: The price hits the Stop Price trigger but then flies past the Limit Price immediately, leaving the order unfilled and the trader exposed.

The choice is always a trade-off: speed vs. price vs. certainty. Professional traders develop execution protocols for different market regimes (e.g., highly liquid vs. low liquidity) and volatility levels, often testing order behavior extensively in demo environments before applying them live. (Internal Link: Slippage Control)

Closing Section

Mastering the intricacies of trading order types is the bedrock of disciplined, professional trading. Every order instruction from the aggressive Market Order to the sophisticated, hidden Midpoint Peg is a precise tool that defines execution outcome, manages positional risk, and implements a strategy.41 Traders who treat the Limit Order Book as a passive backdrop miss the fundamental reality: it is an active, competitive environment where queue priority, time-in-force, and price conditions determine success.

Understanding how an IOC differs from an FOK, or how a Stop Market order exposes one to volatility gap risk compared to a Stop Limit, is the difference between controlled risk and speculative exposure. The evolution of market structure, the fragmentation across venues, and the rise of algorithmic orders (TWAP, VWAP) only increase the complexity and the necessity of this knowledge.

At MEXQuick Academy, we emphasize that technological sophistication must be paired with foundational education. Our AI systems can automate the efficient routing of complex bracket and algorithmic orders, but the initial risk parameters are always set by the informed human trader. Every order is a decision knowing how it works is your edge.